Steps to Take if You Received a Surprise Tax Bill

There have been a lot of stories about surprised taxpayers this year, and many of those surprises were decidedly unpleasant. Taxpayers who had received large refunds for years were shocked to find…

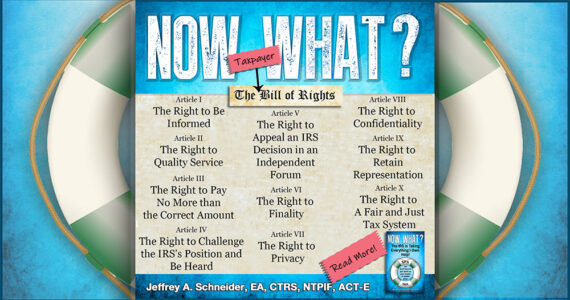

The Taxpayer Bill of Rights

Did you know that you have your own Bill of Rights as a taxpayer? These are the protections and fundamental rights you have with the IRS The IRS has adopted a Taxpayer Bill of Rights for all its…

The Taxpayer Representative: There’s More to Sailing than Leaving the Dock

“Not everyone is qualified to be a captain of a ship. When you’re miles from land and things get dicey, you want an Admiral, not a weekend sailor. You need a professional who knows what he or she is…

IRS Radar: Common Targets for Audits

If you’ve read our Top Ten post about avoiding certain red flags, you’re probably aware that some issues are more likely to give rise to an audit than others. Former senior attorney with the Internal…

You Have It, We Want It

Forget 10,000 Leagues Under the Sea. You’ll have to dive much deeper than that to get to the heart of the IRS. When it comes to the administration and enforcement of our tax system, there are four…

The Role of the Taxpayer, the Tax Representative, and the IRS

The Role of the Taxpayer, the Tax Representative, and the IRS. An SFS Tax Problem Solutions Blog. The Role of the Taxpayer, the Tax Representative, and the IRS When you are dancing, only one person…

Would You Like a Fresh Start? Press the Reset Button on Your Taxes

Debt can be a dark cloud that hangs over everything you do. When it comes to taxes, it’s that much worse. The more you ignore a tax debt, the bigger the debt gets, as penalties and interest are added…

In Trouble with the IRS? Here's What You Need

You’ve probably heard someone who represents himself has a fool for a client. This is just as true when it comes to the IRS as it is in a criminal court. If you’re in trouble with the IRS, you need…