You Have It, We Want It

Forget 10,000 Leagues Under the Sea. You’ll have to dive much deeper than that to get to the heart of the IRS.

When it comes to the administration and enforcement of our tax system, there are four basic levels:

- Examinations (Audits)

- Collections

- Appeals

- Criminal Investigations

It’s time to talk about the first three.

Examinations (Audits)

When a return is filed and processed, it is automatically deemed correct unless the IRS computers find an error.

What types of errors are picked up by the computers?

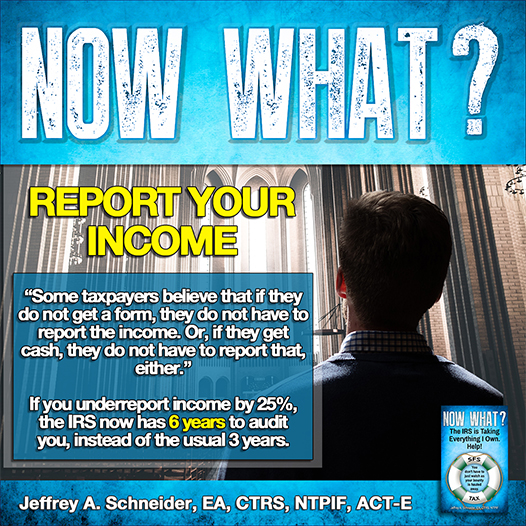

If you understate the income reported, overreport expenses, or report you had health insurance when you did not, the computer spits out a notice showing what they have compared to what you’ve put on your return.

Sometimes, you’ll get selected for audit (done locally or by mail). The auditor can pick up on these same errors or omissions.

Collections

The Internal Revenue Service is the world’s largest and most aggressive collection agency. Even with their funding woes, they can and will come after you (either in person or by mail – never a phone call or email.)

One of the IRS collection units is the Automated Collections Service, or ACS. They have various service centers around the country. Then, there are Settlement Officers. These officials are usually in the IRS Appeals Office.

Appeals

A taxpayer usually gets one shot at appeals. The next step is to prepare and file a tax court petition. Generally, you can file this once you receive a 90-day notice (Statutory Notice of Deficiency.) You can prepare the petition:

- yourself

- by a U.S. Tax Court Practitioner

- by an attorney licensed to practice in your state

Currently, there is a $60 fee. You will wait until your petition gets on the court docket. Then, it is assigned to an IRS lawyer. Most of the time, IRS attorneys will “send it back to appeals,” because most cases are not USTC worthy (i.e. not enough money).

If you do not want to go to court (it is not cheap unless you do it yourself, and that is not highly recommended) and you cannot/do not pay, that is the crux of this book.

Just as you have the right to appeal an IRS decision, you also have the right to be represented.

************************************************

Jeffrey Schneider, EA, CTRS, NTPI Fellow has the knowledge and expertise to help you reach a favorable outcome with the IRS. He is the head honcho at SFS Tax Problem Solutions as well as an Enrolled Agent, a Certified Tax Resolution Specialist and Advanced Crypto Tax Expert.

************************************************

Author of the Now What? Help! series, Jeff defines and deconstructs IRS notices and clarifies letters and actions the IRS will take to get what they want. He interprets the world of the IRS in a fashion that mixes attention to detail with humor to help you better understand and resolve your tax problems.

The books are available in paperback and eBook on Amazon.

************************************************

For more on SFS Tax Problem Solutions, visit http://sfstaxproblemsolutions.com/

************************************************

738 Colorado Avenue Stuart, FL 34994

************************************************

Phone: 877-355-8010

************************************************

https://twitter.com/SFSTax/

https://linkedin.com/company/sfs-tax-problem-solutions

************************************************