V is for Victory – An IRS Tax Settlement

V is for Victory – An IRS Tax Settlement

Remember when trips to your mailbox were scary and unsettling? The profound expectation of receiving a notice from the IRS was always top of mind.

At first, you ignored them. Then the notices became more frequent until the top of your desk, and the kitchen counter were littered with unopened correspondences.

Your spouse was on your case because you hadn’t filed taxes for several years. By your estimation, you owed well over 500K, not including penalties and interest. Additionally, your marriage was rocky, and your kids felt the discord’s brunt. Then, you finally admitted that you had to do something.

Tax Resolution Services

Radios and tv commercials for tax resolution services were showing routinely, and you finally threw up your hands and decided to act, the first step in getting your life back. The big-box companies were impersonal, and you felt that you would be just another client to them. A well-respected local firm was your best option. You called local Enrolled Agent and Certified Tax Resolution Specialist Jeffrey Schneider’s EA, CTRS, ACT-E, for help, and you and your wife met with him immediately.

Providing him with the required documents took time because your paperwork wasn’t organized. However, once he finally had the paperwork, a power of attorney, and your retainer, he got on the phone and stopped the IRS from contacting you because he was your representative.

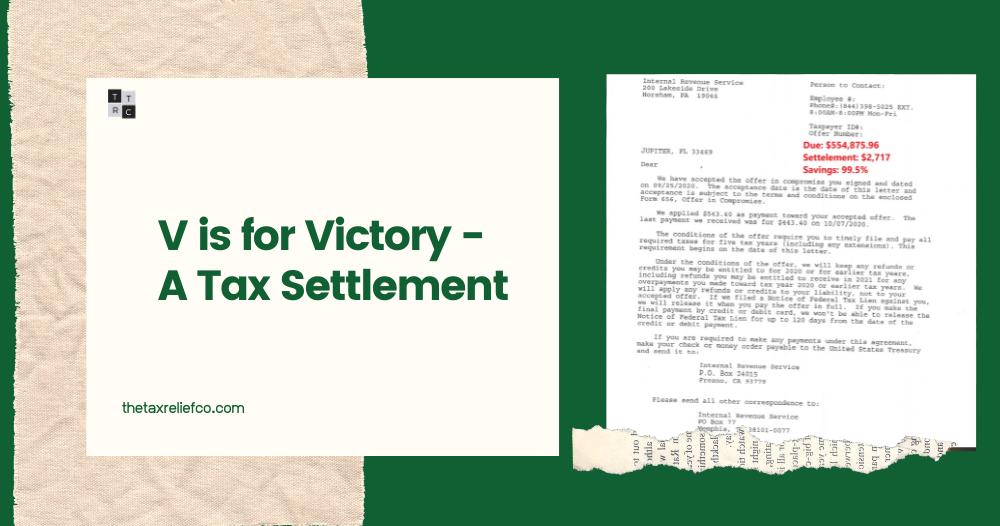

Then you never had to speak with the IRS again. Schneider kept you up to date about his negotiations with the IRS until many months later. They finally accepted his offer. At this point, you discovered Schneider’s superpower, negotiating with the IRS. The settlement was 99% of what was owed. What a victory!!

What is a tax settlement?

A tax settlement is an agreement that the IRS or the state taxing authorities accepts that allows a taxpayer to pay an unpaid tax liability for less than the original amount owed.

Not every situation is suitable for entering into the tax settlement process. However, individuals who owe taxes frequently find that the agencies are willing to consider the individual case to determine if a tax settlement is possible. The settlement is based on current tax regulations and the taxpayer’s situation.

My IRS tax problem was resolved!

The IRS offers settlements to taxpayers struggling with their tax obligations or having valid reasons to abate their penalties. Unfortunately, not everyone is eligible for a tax settlement.

When determining if the taxpayer will qualify for a tax settlement, the IRS’s main factor is their financial situation. If the taxpayer is undergoing financial hardship, it’s usually a good indicator to the IRS that a settlement might be a good option.

Jeffrey Schneider, EA, CTRS, ACT-E, has over 40 years of experience assisting taxpayers that find themselves with tax complications. If you owe more than 10K, contact us today to set up a free strategy session, at which time we can assess your tax situation and determine how we can help you eliminate your tax nightmare.

Contact us today by calling 877-355-8010 or book an appointment online.