U is for Unrepresented Taxpayers

U is for Unrepresented Taxpayers

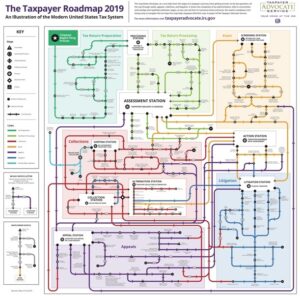

Do you know the ins and outs of the IRS rules and the constantly changing tax laws? You may have Googled a specific tax law, but you probably cannot say on top of all the changes as an unrepresented taxpayer.

If you needed heart surgery, you wouldn’t have a dermatologist perform the procedure, would you? You would seek a specialist, a cardiac, thoracic surgeon.

If you owe the IRS over 10K, would you represent yourself in front of the IRS? You could, but challenging the IRS yourself would not be in your best interest. Do you know the ins and outs of the IRS rules and the constantly changing tax laws? The IRS is the largest and most aggressive collection agency on the planet. So, when you face the IRS, you need knowledge and experience on your side.

Discussions with the IRS are often tense and can be overwhelming. Building a robust case to support your position can be challenging. However, a trained and experienced tax resolution specialist, such as I, will guide you through the examination and appeals process as well as recommend effective methods to resolve your case. Without proper due diligence, you can find yourself in uncomfortable situations. Of course, compliance is vital in every aspect of your case, and paying attention to the current issues that the IRS has focused on is essential.

You can talk directly to the IRS and negotiate a deal.

Some individuals manage to negotiate a reasonable settlement with the IRS. For example, they get the IRS to drop all the penalties and some or all the interest. In addition, they can designate their payment on an installment agreement. However, this is the exception, not the rule, and is usually achieved when the IRS can quickly determine additional collection efforts would produce no other payments.

It is important to remember that the IRS is not your friend. They do not have your best interest in mind. They work for the Department of Treasury and the US Government, and their job is to collect all revenues due and to see that taxpayers pay the taxes they owe. Therefore, they will agree to a settlement that benefits the agency more than the individual or business.

Learn more on this blog; The IRS is Not Your Friend. Caution Needed.

Time is not on your side.

If you call the IRS, there’s only a 1-in-50 chance you’ll reach a human being, and according to a clerk at the US Treasury Department, the average wait time is around 2 hours. So, do you have the time to sit and wait?

The IRS sends a lot of correspondence regarding unfiled taxes. These notices include deadlines and possible hearing dates. Additionally, they detail what is needed to complete the collection gathering process. Documents must be collected, filled out, and submitted on time. Do you have the time to handle all phases of negotiation with the IRS, or is hiring someone to assist your efforts a better solution?

IRS deadlines.

When IRS deadlines are missed, they will escalate their collections efforts.

- They may levy your business’s accounts receivables or bank accounts.

- For individuals, the IRS may garnish income or levy bank accounts.

It can take weeks or months to get everything caught up financially after a levy, which prevents you from having the ability to address the tax liability.

It may also prevent you from paying current taxes, worsening the tax problem. The longer a tax liability is not in a formalized IRS payment agreement, the more penalties and interest can accrue.

An experienced tax resolution specialist takes the burden off your shoulders, which helps you sleep at night. Unopened notices from the IRS aren’t covering the top of your desk, and that nervous feeling in the pit of your stomach is gone.

It’s essential to have someone aggressively working to resolve your tax problem. Then, once you’ve provided the requested documentation, you can simply call for progress updates. The best benefit of hiring a certified tax resolution specialist is peace of mind.

What Should You Do?

It’s good to consult with a tax professional. Each tax case is unique and has a variety of factors that play into how best to address an IRS collection matter.

Jeffrey Schneider, EA, CTRS, ACT-E, has over 40 years of experience assisting taxpayers that find themselves with tax complications. If you owe more than 10K, contact us today to set up a free strategy session, during which time we can assess your tax situation and determine how we can help you eliminate your tax nightmare.

Contact us today by calling 877-355-8010 or book an appointment online.

#unrepresentedtaxayer #taxrelief #taxproblems #IRS #enrolledagent #certifiedtaxresolutionspecials #thetaxreliefco #taxjam