The Tax Resolution Alphabet – D is for Debt Relief

If you are struggling with IRS tax debt and feel like it’s a hopeless situation, it may not be as awful as you think. The IRS Fresh Start Program was created to make it easier and more accessible for people to repay or settle their tax debt.

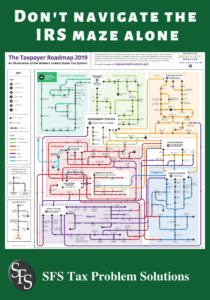

Taxes often seem overwhelming and overly complex, almost like a project that you didn’t research and were unable to complete.

About the Fresh Start Program

The IRS initiated its Fresh Start Program in 2008 and expanded it in 2012 to ease the financial burdens of taxpayers who owe up to $50,000 in taxes. It is available to both business owners and individual taxpayers

The program is designed to allow taxpayers to pay off substantial tax debts affordably over the course of six years. Each month, taxpayers make payments that are based on their current income and the value of their liquid assets.

It simplifies the process of paying back large tax debts. It also helps people avoid many of the damages of owing a tax debt to the IRS including:

- Accrued Interest

- Recurring Penalties

- Tax liens

- Seizure of assets

- Wage garnishments

Qualifies for the Fresh Start Program?

In order to qualify for the IRS Fresh Start Program for debt settlement or lien withdrawals, generally you’ll need a couple of things at a minimum:

- Any missing or unfiled tax returns must be filed.

- You are current with your estimated tax payments or your current withholdings are correct, and they have been so for the last 6 months.

Can the IRS ReallyTake My Money and Assets?

The IRS and Department of Treasury can really take your money and possessions. There are ways to combat these aggressive tactics. Learn more by reading my book, Now What? The IRS is Taking Everything I Own. Help!. Available on Amazon, https://amzn.to/2r0uNUH.

In difficult times, many families have trouble meeting their commitments. If you’re worried about the IRS garnishing your wages, levying your bank account, or taking your assets, then reaching out to our firm and getting a free, no-obligation, confidential consultation on your tax problem may give you some peace of mind. Our firm will explain the many other tax relief options available to you. Contact us now.

Visit our website, sfstaxproblemsolutions.com to book your Free Debt Settlement Analysis at https://go.oncehub.com/jeffreyschneider.

Don’t try this on your own. Let Certified Tax Resolution Specialist and Enrolled Agent Jeffrey Schneider, EA, CTRS and SFS Tax Problem Solutions team help you find the light at the end of the IRS maze and put you on the road to tax relief.

Don’t try this on your own. Let Certified Tax Resolution Specialist and Enrolled Agent Jeffrey Schneider, EA, CTRS and SFS Tax Problem Solutions team help you find the light at the end of the IRS maze and put you on the road to tax relief.