July 26th, 2018

Inside this edition:

- Embezzled Money Must be Reported on Your Tax Returns

- Karaoke Bar Owner will be Singing a Different Tune in Prison

- A Bit of Humor

- The IRS Reports a Surge in Email Phishing Schemes

- Question & Answer

- For the Foodies …

“Most taxpayers do not realize that they have the right to be represented when it comes to dealing with the IRS.

“Most taxpayers do not realize that they have the right to be represented when it comes to dealing with the IRS.

Embezzled Money Must be Reported on Your Tax Returns

Karaoke Bar Owner will be Singing a Different Tune in Prison

A Bit of Humor…

“The present tax code is about 10 times longer than the Bible, a lot more complicated, and, unlike the Bible, contains no good news.”

—Don Nickles, former U.S. Senator

Virginia Couple Tries to Outsmart the IRS

and Gets Caught

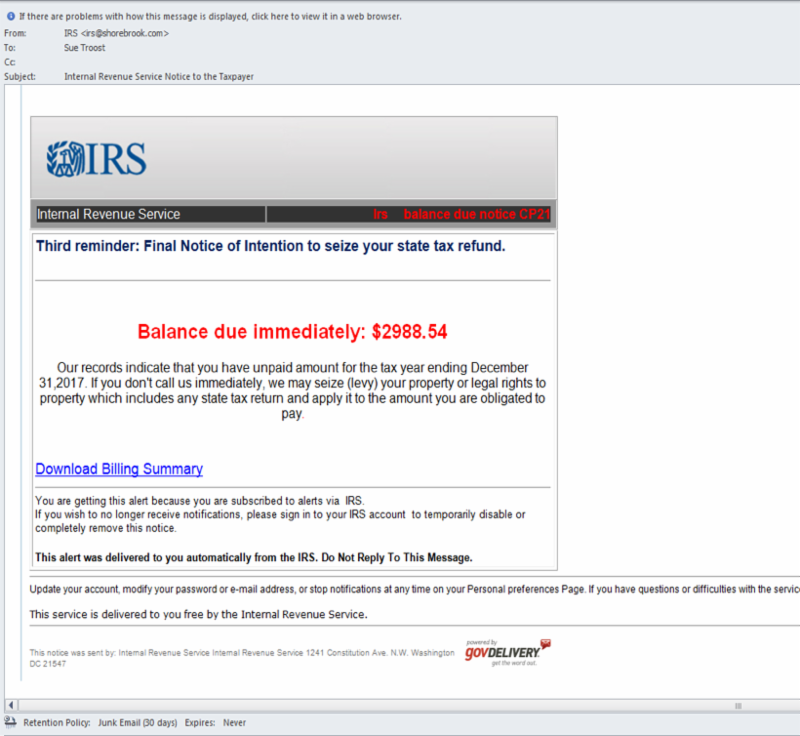

Phishing is a scam where fraudsters send email messages to trick unsuspecting victims into revealing personal and financial information that can be used to steal the victim’s identity. To trick taxpayers into thinking the emails come from the IRS, they use the actual logo, so victims think it’s an official communication. These emails contain various scare tactics, and they ask the person to confirm personal information and verify their PIN information.

I’d like to hear from you…

If you have an IRS issue, or just want to refer a friend, relative or client, I’d love to hear from you. I can provide a no-obligation, confidential consultation to help you solve your IRS problems.

Thank you for your kind words

![]()

Jeff and his staff have helped our family through our tax troubles in the past. And I know he’ll continue in the future. – Don Musante

Q & A

Answer:

For the foodies…

Jamaican Steamed Cabbage

Find the recipe, Jamaican Steamed Cabbage, on the SFS Tax Problem Solution Pinterestpage along with other pins and videos.