January 2021

Introducing the

The Tax Relief Company

The Tax Relief Company is dedicated to helping individuals and businesses resolve their tax problems once and for all.

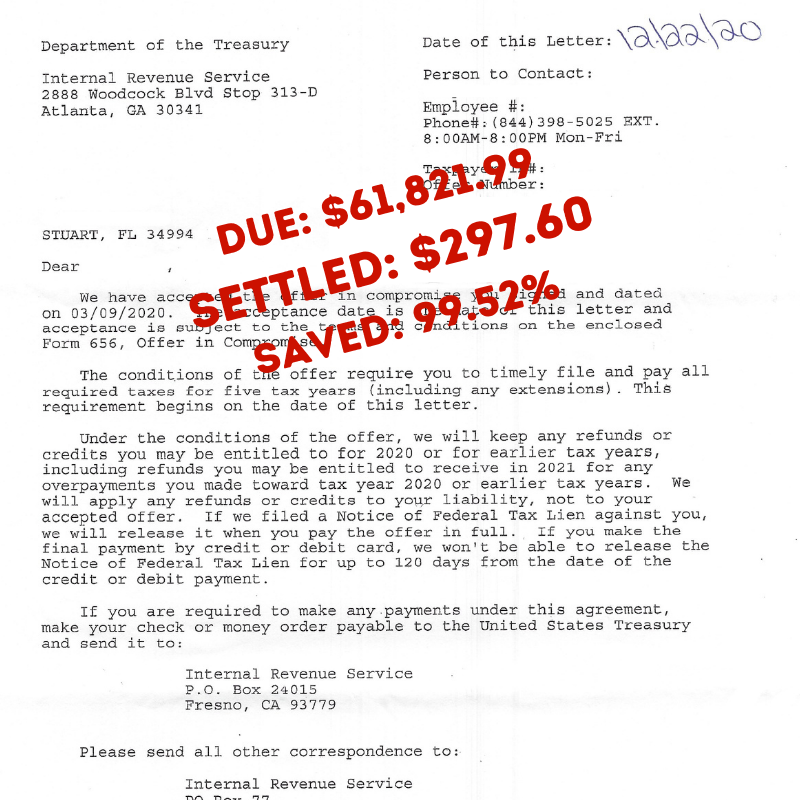

The wave of IRS collection action has begun. The IRS halted the mailing of collection notices in May 2020 due to COVID. Throughout the country, taxpayers have begun receiving IRS notices advising of their balance due. These letters and notices should be taken seriously and acted upon immediately as they hold serious and far-reaching consequences. Failure to act upon these correspondences timely is often more costly, significantly more time-consuming to resolve, and difficult.

Please call us if you received a notice. We want to help give you your life back and settle with the IRS or state. Once retained, you will no longer have to speak to the federal or state taxing agencies. What a relief that is!

As 2021 kicks off, we want to offer you an exceptional, limited-time incentive to get you to deal with your tax problem now. We need to determine how the IRS is investigating you and exactly how much you actually owe them.

YOU PAY

$0.00

(Value$1500.00)

Our offer is valued at $1500.00 to the first ten individuals or business owners with a tax debt of over $10,000.00 and retains our services.

We will obtain your records, carefully evaluate them, and put together the best plan of action to get you tax relief.

Is the IRS taking everything you own? Find out in the second book. For FREE.

Get a FREE copy of Jeffrey Schneider’s book from the bestselling tax relief series Now What. Help! when you sign up today.

News, Updates & Tips

Ask Alyin the Tax Husky

Aylin, I own a small business and I do not know if PPP loan expenses are deductible. Can you help me?

Aylin, I own a small business and I do not know if PPP loan expenses are deductible. Can you help me?

Yes, I can.

The PPP Loan Expenses Are Now Tax Deductible. If you or your business received funds from the Paycheck Protection Program (PPP), the recently passed Emergency Coronavirus Relief Act of 2020 will help to dramatically cut your tax bill. Here’s what you need to know.

The PPP program was created by the CARES Act in March 2020 to help businesses that were adversely affected by the COVID-19 pandemic. Qualified businesses could apply for and receive loans of up to $10 million. Loan proceeds could be used to pay for certain expenses incurred by a business, including salaries and wages, other employee benefits, rent, and utilities.

If the business used at least 60% of loan proceeds towards payroll expenses, the entire amount of the loan would be forgiven.

The Tax Relief Company | 877.355.800 | info@thetaxreliefco.com |

https://thetaxreliefco.com