Cryptocurrency Can Save You Thousands in Taxes

Cryptocurrency Can Save You Thousands in Taxes

Cryptocurrency Can Save You Thousands in Taxes

The term “cryptocurrency” is short for “cryptographic currency”. It refers to a new type of digital money. Crypto is a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank.

Although most people tend to forget, Cryptocurrency losses count as capital losses. Deducting those capital losses at tax time can help you move into a lower tax bracket. Moving down a bracket can result in thousands of dollars of tax savings.

Deducting a capital loss on your tax return is not as hard as you’d think. We’ll even tell you how it’s done.

Capital Losses and Capital Gains

The IRS categorizes each transaction you make when trading cryptocurrency in one of two ways. Each buy or sell order results in either a capital loss or a capital gain. You also have short term or long term depending if you held the currency for one year or more.

If you bought an entire Bitcoin at the beginning of the year when the price was hovering around $10,000 and sold today for $3,700, you would incur a $6,300 (short term) capital loss. You can then use this loss to move into a lower tax bracket.

Moving into a lower bracket can save you thousands

If you lost money trading cryptocurrency in 2018, your losses will count against the net income that you earned during the year.

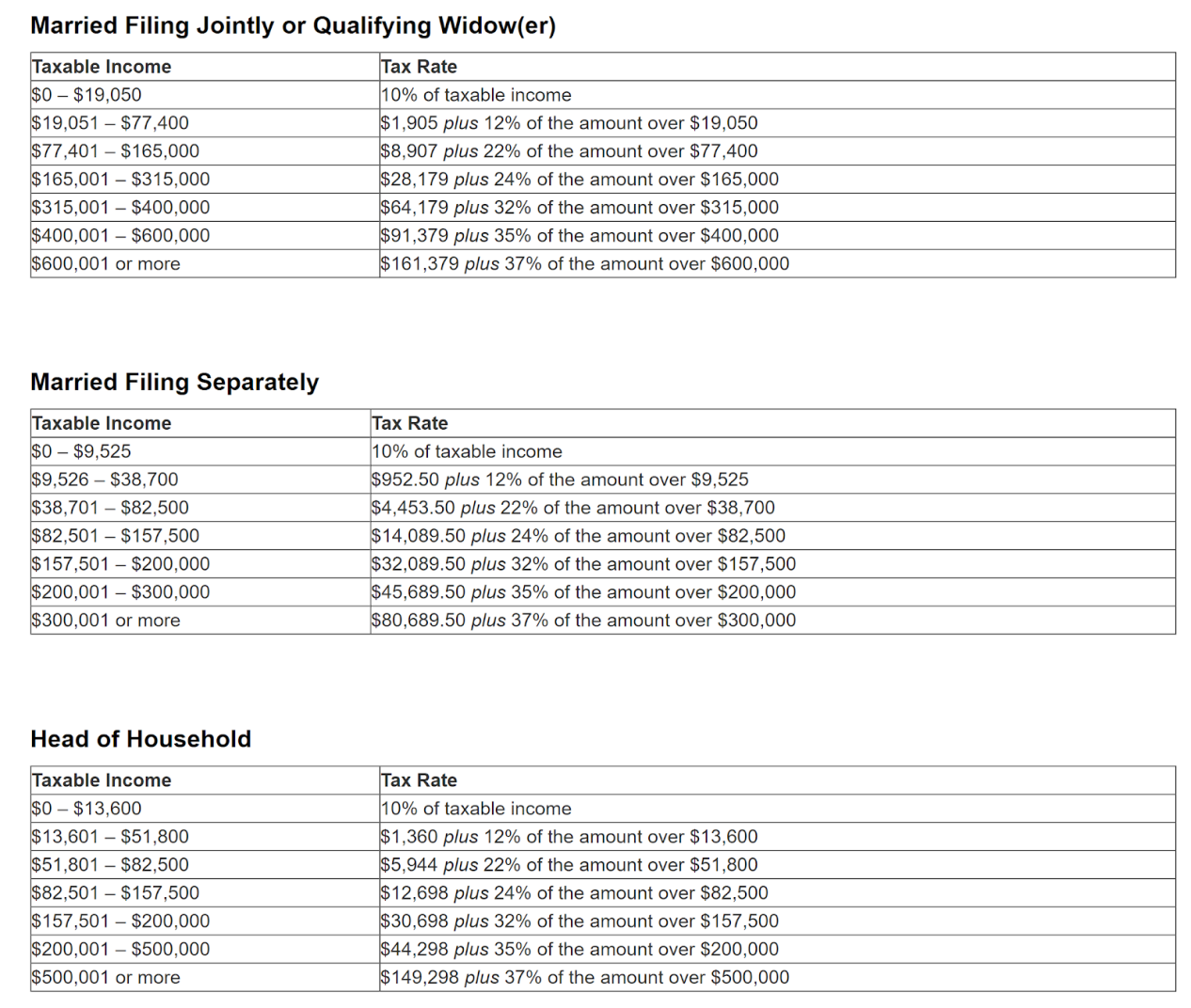

The image below shows the tax brackets that the IRS uses to determine how much you owe. As you can see, the difference between the two brackets is quite large. The base rate for single individuals that made between $82,501 and $157,500 is nearly four times the base rate for single people that made between $9,526 and $38,700.

Married people filing jointly can save even more by dropping to a lower bracket.

Married people filing jointly can save even more by dropping to a lower bracket.

You can deduct up to $3,000 from ordinary income

You can deduct up to $3,000 from ordinary income

The IRS allows you to deduct up to $3,000 from ordinary income.

Losses can offset taxable gains—even on other investments such as stocks or land. Any excess losses – up to $3,000 – can also offset other types of income. This includes your wages, and unused losses carry forward either forever or until fully deducted.

That means that if your day job puts you slightly above the limit for your particular tax bracket, deducting your crypto losses can help you drop to a lower bracket.

Determining the amount of your loss

If the crypto exchange you use saves a record of your transactions, you may be able to add up these numbers yourself by downloading a CSV file.

If you’re a bit unsure of any of the answers, it’s time to see an Enrolled Agent. The IRS is receiving names and account data from the exchanges (like they did from the foreign banks) and will come after those not reporting their crypto transactions. If you do not report these items, especially the FINCEN, the penalties can be enormous. The FBAR (previously known as FinCEN) is where you have to report accounts in foreign banks that have $10,000 at any moment.

Summary

Let us help you muddle through the process and make sure you are filing returns. We can even amend returns to make sure you are compliant. Of course, if taxes are due, there are collection alternatives we can help you with.

Jeffrey Schneider, EA, CTRS is experienced in all things tax, including the crypto world. As an Enrolled Agent, he is licensed to practice throughout the United States, unlike a CPA or attorney who are bound to practice only in the state they are licensed.

************************************************

Jeffrey Schneider, EA, CTRS, NTPI Fellow has the knowledge and expertise to help you reach a favorable outcome with the IRS. He is the head honcho at SFS Tax & Accounting as well as an Enrolled Agent, a Certified Tax Resolution Specialist and Advanced Crypto Tax Expert.

************************************************

Author of the Now What? Help! series. Jeff defines and deconstructs the scary and confusing letters in a fashion that mixes attention to detail with humor and an intricate clarification of what is what in the world of the IRS.

The books are available in paperback and eBook on Amazon.

************************************************

For more on SFS Tax & Accounting Services, visit http://sfstaxacct.com/

************************************************

738 Colorado Avenue Stuart, FL 34994

************************************************

Phone: 772-337-1040

************************************************

https://twitter.com/SFSTax/

https://linkedin.com/company/sfs-tax-problem-solutions

************************************************