Q is for Qualified Expenses for Collection Alternatives

Qualified Expenses for Collection Alternatives The IRS allows very specific living expenses when you are in collections. Here are the guidelines you need to know. You owe the IRS money. You review…

P is for Properly Structured IRS Payment Plan

P is for Properly Structured IRS Payment Plan.A payment plan is an agreement with the IRS to pay the taxes you owe within an extended timeframe. I am sure heard of the term “Installment Agreement or…

O is for Offer in Compromise

You have probably seen TV commercials saying “Settle Your Back Taxes for a Fraction of What You Owe” or “Settle Your Tax Bill for Pennies on the Dollar” it sounds appealing but in reality, it’s…

N is for Not Filing and Paying Your Taxes

Barney and Betty have been married for 20 years and have filed as married for all of those years. Different companies employed them each, and when the pandemic hit, they were both furloughed and…

M is for Marriage

M is for Marriage - This story is about a married couple, Mary and Paul. Mary kept asking her husband these questions, hoping he would finally have an answer. "How did you get us into this financial…

L is for Lien and Levy

Levies are different from liens. A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt. A federal tax…

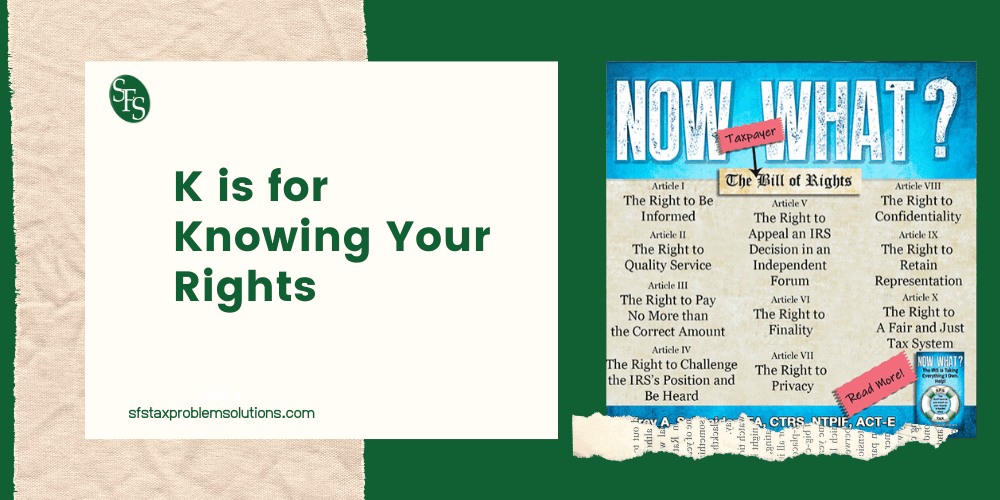

K is for Knowing Your Rights

The Taxpayer Bill of Right The protection and fundamental rights you have with the IRS The IRS has adopted a Taxpayer Bill of Rights, as proposed by National Taxpayer Advocate Nina Olson. It applies…

J is for Jeopardy Assessment

Overview: Jeopardy assessments are made in situations where, prior to the assessment of a deficiency, it is determined that the assessment or the collection of such deficiency would be endangered if…

I is for Innocent/Injured Spouse Relief

I is for Innocent/Injured Spouse Relief – The Takeaway: When you file a joint return, you and your spouse share in the responsibility to pay the tax. The IRS can collect against each of you…